Gold consolidates but remains vulnerable to renewed selling pressure

Gold prices slipped as much as 1% to $3305 an ounce after gaining 0.7% the previous day as signs emerged that President Donald Trump may ease auto-related tariffs. A White House official indicated that some levies on imported auto parts would be lifted and tariffs on cars, aluminum and steel might also be relaxed. The move dampened safe-haven demand for gold amid hopes of easing trade tensions. Meanwhile, a stronger U.S. dollar added further pressure, making gold more expensive for foreign buyers.

As the week advances, traders will keep a sharp eye on central bank remarks and forthcoming economic data, looking for signs of how the U.S. economy is shaping up. These insights could play a crucial role in determining gold’s near-term price direction. Amid ongoing economic volatility and the unresolved trade dispute, gold remains a key asset, maintaining its reputation as a safe haven during uncertain times.

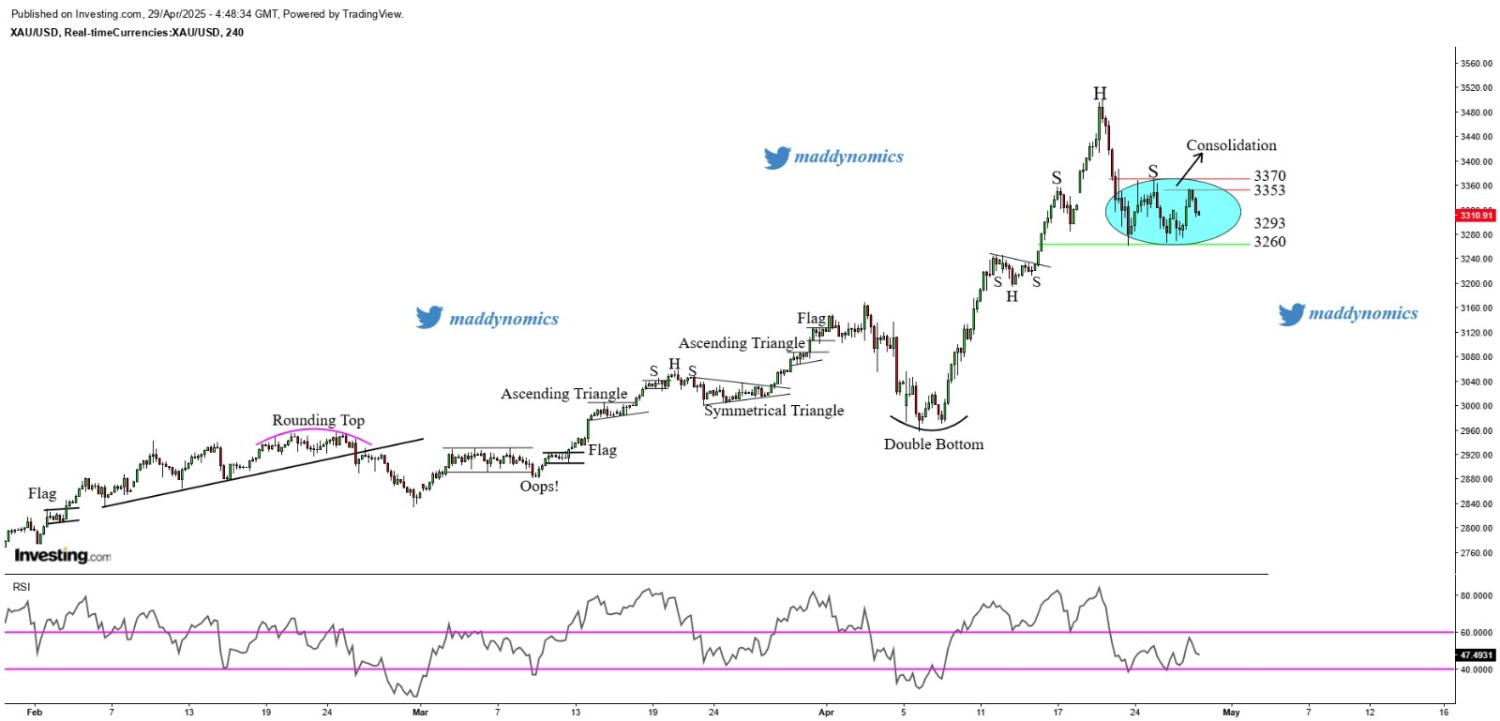

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is displaying mixed signals across multiple timeframes. On the daily chart, a Narrow Range 3 (NR3) candle and a Hanging Man pattern suggest potential exhaustion near recent highs. Price action on the 4-hour chart shows consolidation, indicating indecision. However, on the 15-minute chart, a breakdown from a Head & Shoulders pattern and the formation of a Bear Flag point to bearish momentum in the short term.

Intraday Trend/ Intraday Strategy: The short-term trend remains bearish/ Traders may look to sell near resistance levels or on breaks of key support levels.

Weekly Trend: Bullish

Major Resistance: 3322, 3337, 3353

Major Support: 3308, 3300, 3286

Recent News

US Tech 100 Bearish Triangle Signals Bre...

May 30, 2025

Market Insights

DAX making a Flag on Daily chart

November 26, 2024

Market Insights

Gold holds at Ascending Triangle Support...

August 21, 2025

Market Insights

Silver forms massive Inverted Head & Sho...

August 13, 2025

Market Insights

WTI climbs on US–China tariff truce; mar...

August 12, 2025

Market Insights

DOW JONES bounce back after President Do...

October 13, 2025

Market Insights