Gold clears major resistance levels of 2617$ amid escalating Russia-Ukraine Conflict.

Gold price builds on Monday's gains and rises toward $2,640 as risk-aversion grips markets amid intensifying geopolitical tensions between Russia and Ukraine. Meanwhile, the 10-year US Treasury bond yield is down more than 1% on the day, further supporting XAU/USD. Investors sought clarity on the Federal Reserve’s monetary policy direction. The likelihood of a Fed rate cut in December currently stands at 59%, reflecting a slight decline from previous days.

Market participants also closely monitor potential cabinet picks by US President-elect Donald Trump, whose protectionist policies could influence gold prices. Anticipating critical appointments that may shape Trump’s economic policies adds to market sensitivity.

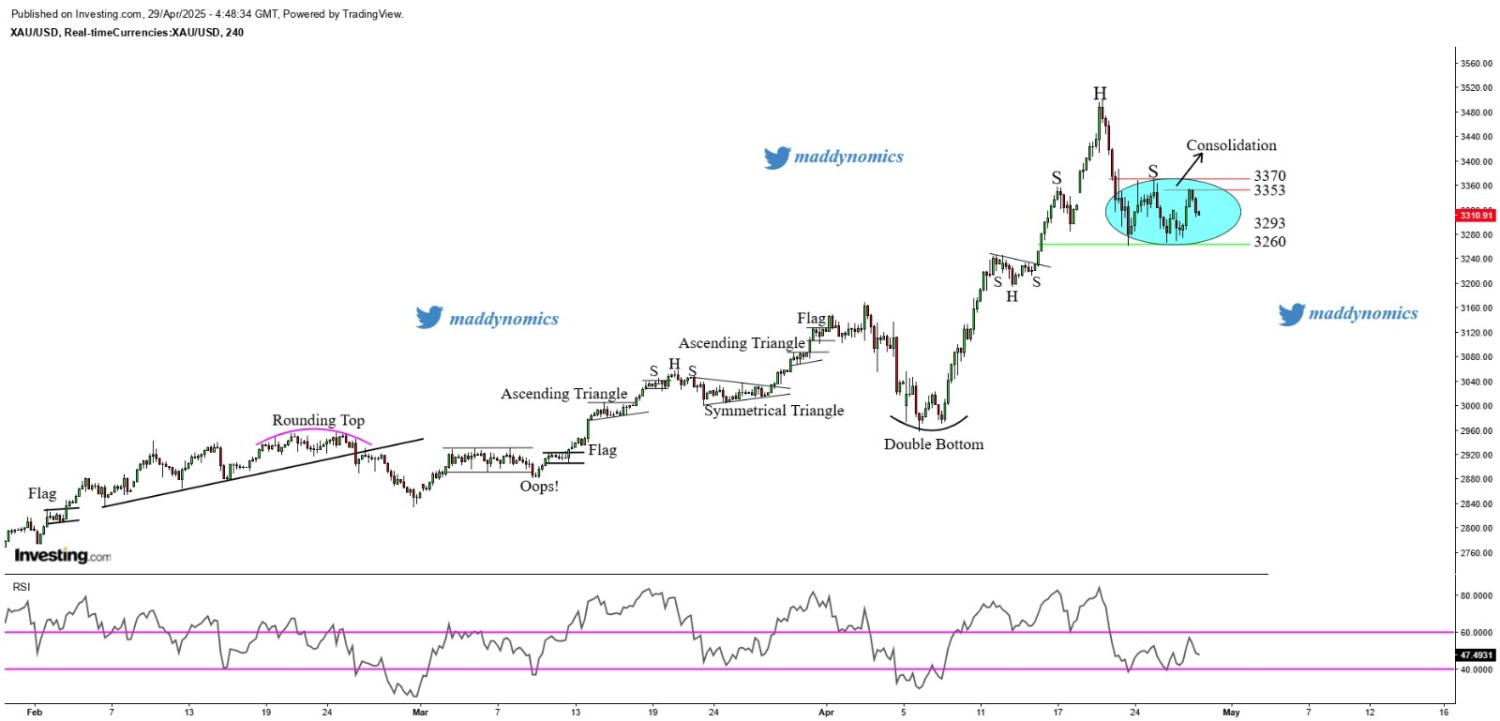

Technically, Gold has cleared major swing resistance at $2617 levels & currently trading at $2635. Its approaching near 55DSMA placed at $2644 levels. If Gold is able to cross this resistance then prices may extend towards the levels of $2675-2680 zone. Alternatively, the bulls may lose momentum below $2616 levels. Overall Traders can maintain Buy on Supports Buy on Breakout Strategy.

Recent News

Gold sellers take a brief pause ahead of...

May 13, 2025

Market Insights

Nasdaq 100 Futures Rally Breakout from B...

April 10, 2025

Market Insights

NAS100 Forms Bearish Pennant Near Resist...

August 26, 2025

Market Insights

Dow Jones Trades Near Key Support as Bea...

March 13, 2025

Market Insights

Gold consolidates but remains vulnerable...

April 29, 2025

Market Insights

Gold Steadies Above $2,942 as FOMC Minut...

February 20, 2025

Market Insights