Dollar Index at critical level showing signs of a bounce

Dollar Index is currently trading at 107.20(up 0.19%) on Wednesday & showing signs of a bounce back from a critical level of 106.50 where in the month of September the breakout happened. The Federal Reserve will publish the minutes of the January policy meeting later tonight. According to the CME FedWatch Tool, markets see virtually no chance of a rate cut in March. This publication is unlikely to influence the market pricing of the Fed rate outlook in a significant way. Hence, the risk perception could continue to drive the US Dollar's valuation.

Technically after making a H&S pattern on daily chart, Dollar found the support around 106.50 Levels. However its still trading below 8 & 20SMA on its Daily Chart. On upside 107.40 is a crucial resistance for Dollar following 107.70. On the downside if Dollar Index starts to trade 106.85 then it can test 106.50 & 106 levels in coming days.

Recent News

Dow Jones Industrial Average struggles t...

December 17, 2024

Live Charts

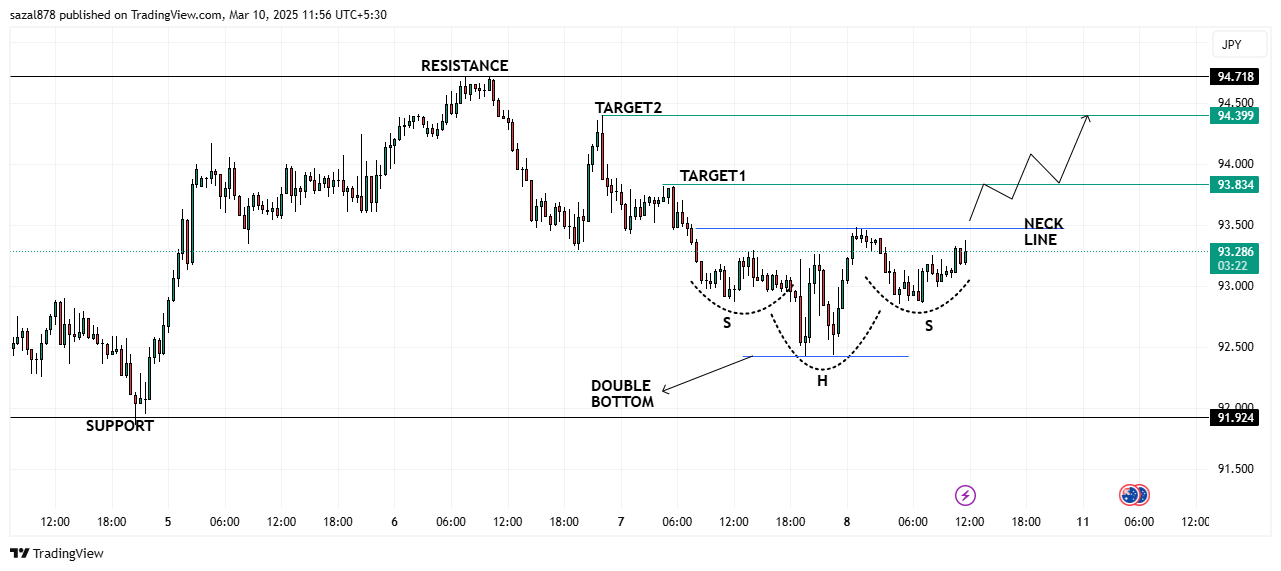

AUDJPY Bullish Reversal Pattern: Head &...

March 10, 2025

Market Insights

Gold Retreats from Record Highs as Trade...

April 23, 2025

Market Insights

DOW JONES Forms Bullish Pennant Pattern,...

October 15, 2025

Market Insights

Gold price languishes near daily low ami...

November 11, 2024

Market Insights

GBPUSD making a Bearish Flag

November 21, 2024

Market Insights