Gold’s Outlook Amid High Yields and a Strong Dollar: Can It Hold as a Safe Haven?

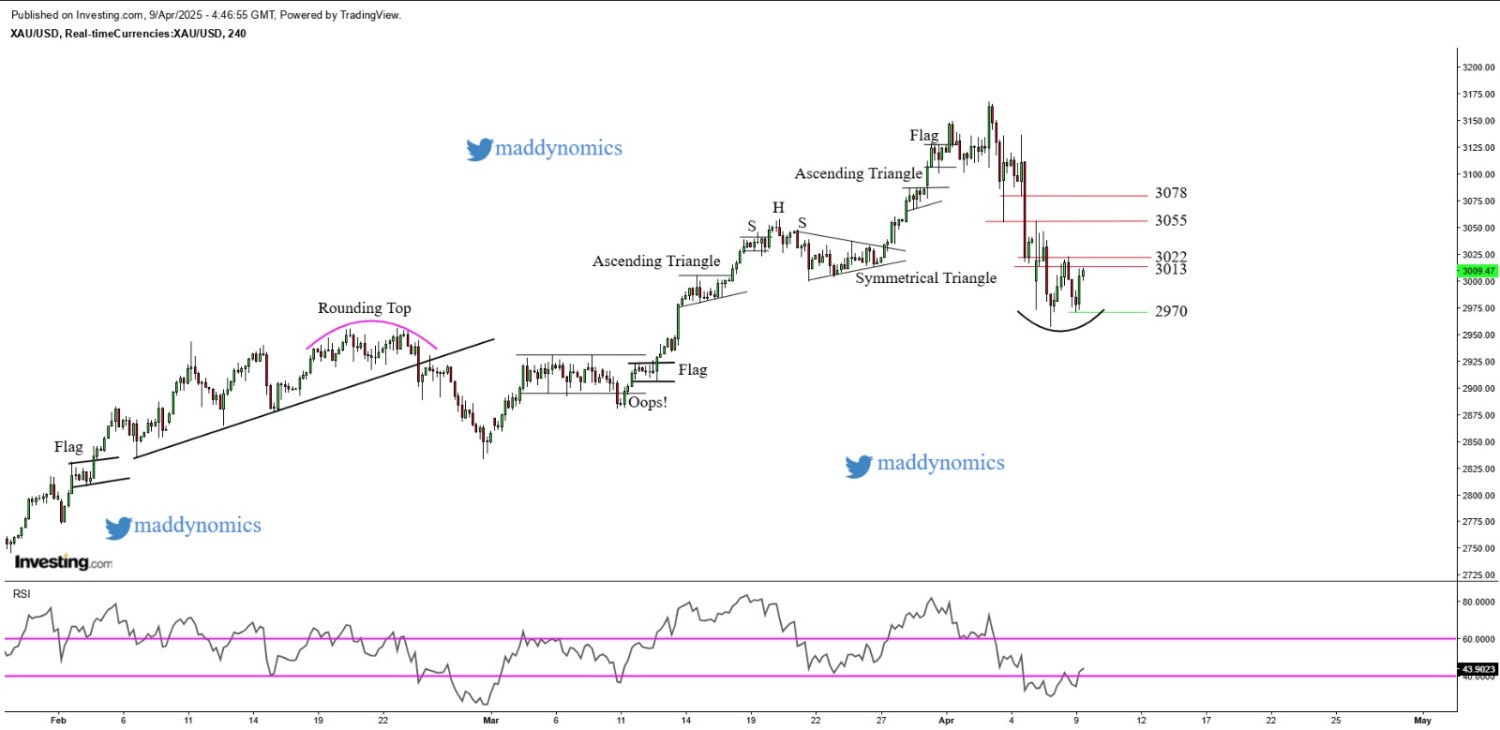

Technical Setup

- Resistance: Gold faces strong resistance near the $2,800 level.

- Support: The recent breakdown from the key $2,600 support zone and a bearish flag pattern suggest further downside, with the next support near $2,520.

- 200-Day EMA: Gold has slipped below the 200-day EMA (currently at $2,667), indicating bearish momentum.

Long-Term Bullish Drivers

Despite immediate pressures, gold retains its safe-haven appeal against inflation, fiscal deficit concerns, and geopolitical risks. Low or negative real yields could eventually support gold’s demand, making it a viable hedge as economic uncertainties persist.

In summary, while gold may face short-term technical pressures, its long-term safe-haven allure remains robust. Investors may watch for potential support levels and signs of recovery amidst broader economic risks.

Recent News

Gold Drops After $2,900–$3,000 Rejection...

February 28, 2025

Market Insights

Gold Shines Bright Testing ATH Resistanc...

May 24, 2025

Market Insights

Gold regains momentum on rising safe-hav...

April 09, 2025

Market Insights

GBP/USD Aims for 1.3440 as Bullish Momen...

May 14, 2025

Market Insights

Gold oscillating within a range ahead of...

March 07, 2025

Market Insights

Silver (XAG/USD) Poised for a Breakout...

March 07, 2025

Market Insights